ohio sales tax exemption form contractor

Even if the contract is exempt the contractor is still liable for taxes on property not incorporated into real property improvements such as tools equipment and consumables. Contractors and home remodelers do not collect sales tax on their work.

Construction Exemption Form Fill Online Printable Fillable Blank Pdffiller

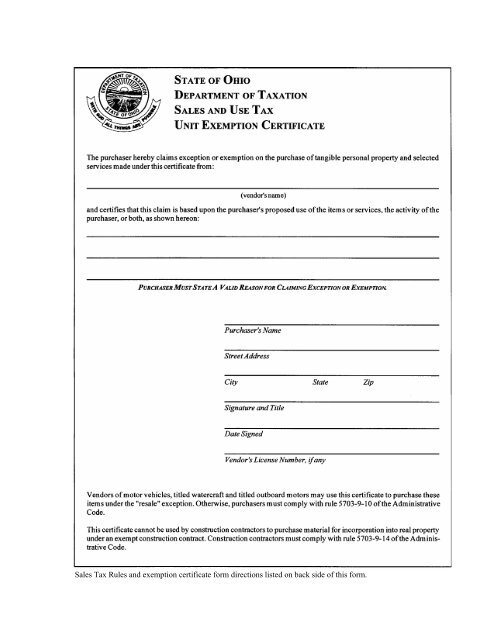

Sales and Use Tax Blanket Exemption Certificate.

. The Unit Exemption Certificate is utilized for the majority of tax exempt purchasing procedures and the Blanket Exemption Certificate is the blanket version of this form. Generally Kent State is exempt from sales tax on purchases and services in Ohio. The contractee shall be deemed to be the consumer of all materials and services purchased under the claim of exemption and liable for the tax on the incorporated materials or.

Goods or materials bought for the construction of projects for certain agencies departments etc. A Except as provided in section 573905 or section 5739051 of the Revised Code the tax imposed by or pursuant to section 573902 5739021 5739023 or 5739026 of the Revised Code shall be paid by the consumer to the vendor and each vendor shall collect. If a contractor does not pay Ohio sales tax on the tangible personal property to its supplier then it generally owes.

A computer data center entitled to exemption under RC. Departments making purchases need to provide an Ohio Sales Tax Exemption to the vendor prior to making the purchase. Sales and use tax.

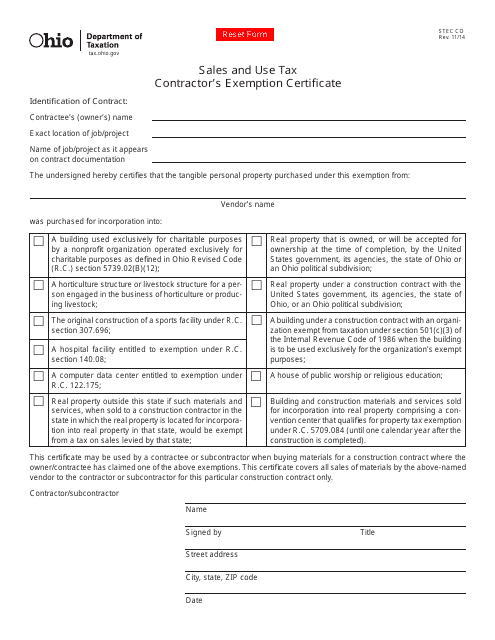

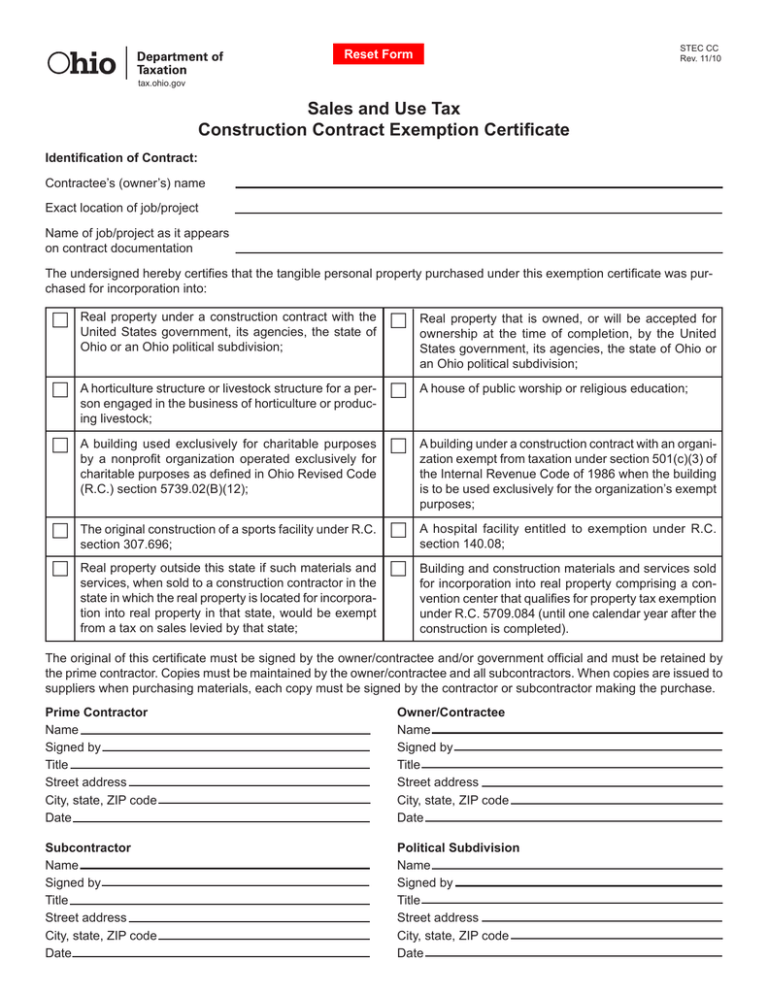

Before making a purchase please check the procurement contractor vendor list. Ad 1 Fill out a simple application. You can download a PDF of the Ohio Construction Contract Exemption Certicate Form STEC-CC on this page.

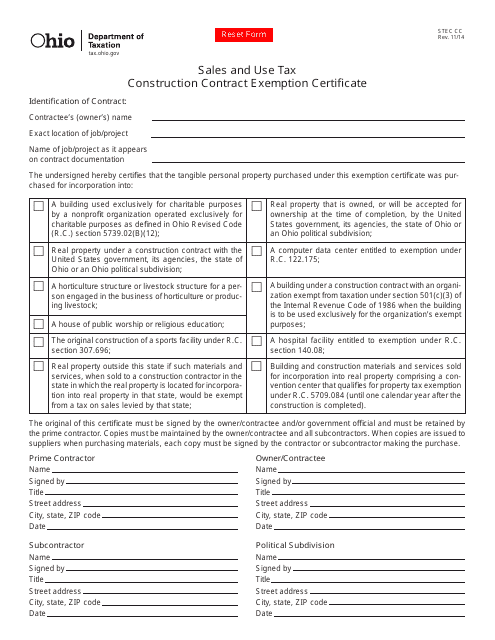

A building under a construction contract with an organi-zation exempt from taxation under section 501c3 of the Internal Revenue Code of 1986 when the building is to be used exclusively for the organizations exempt purposes. The contractee shall be deemed to be the consumer of all materials and services purchased under the claim of exemption and liable for the tax on the incorporated materials or services in the event the tax commissioner ascertains that the contractee was not entitled to exemption. For other Ohio sales tax exemption certificates go here.

Left the South Akron Tile Plant and moved his family to west Akron to build a new life and follow his passion for growing vegetables. Construction contractors must comply with rule 5703-9-14 of the. The goods in question should form an integral form of the end structure or reside within the completed structure.

Grafs Farm Market In 1910 Ernest Graf Sr. Available on the Ohio Department of Taxations website is the form STEC CC which is the construction contract. Exemption refers to retail sales not subject to the tax pursuant to division B of section 573902 of.

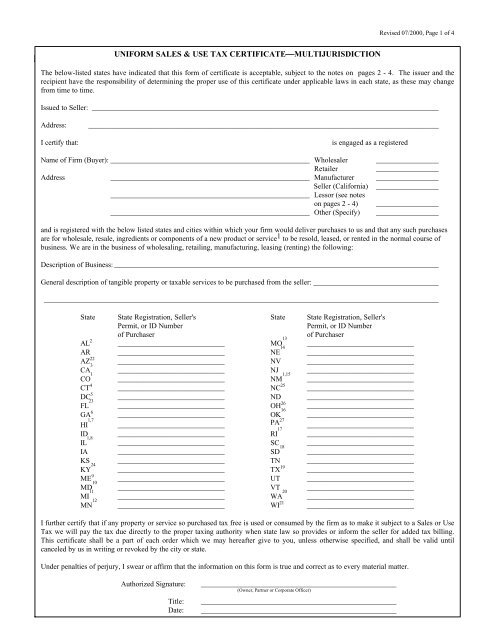

Istrative CodeThis certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract. These include construction contracts whereby building materials are incorporated into real property under a contract with a government agency or into a horticulture or livestock. The contractor must use a separate Form ST1201 Contractor Exempt Purchase Certificate for each project.

2 When claiming exemption under paragraph D1 of this rule the contractee and contractor must issue exemption certificates in accordance with paragraphs I and J of this rule. Download Or Email STEC CO More Fillable Forms Register and Subscribe Now. Step 3 - Describe the reason for claiming the sales tax exemption.

A hospital facility entitled to exemption under RC. The state of Ohio provides certain forms to be used when you wish to purchase tax-exempt items such as prescription medicines. For other Ohio sales tax exemption certificates go here.

Sale Tax Exemption Form information registration support. Step 2 - Enter the vendors name. Handy tips for filling out Ohio sales tax exemption form online.

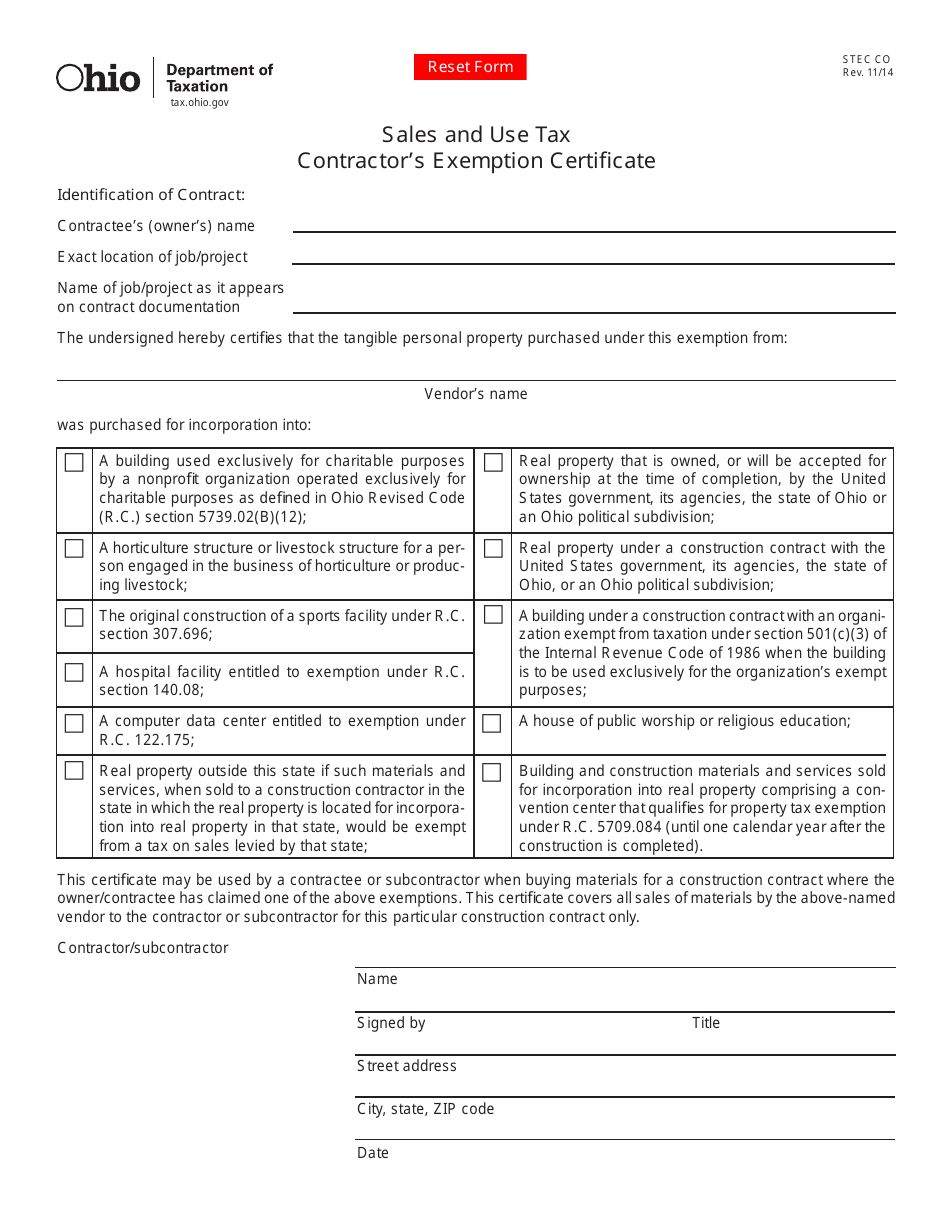

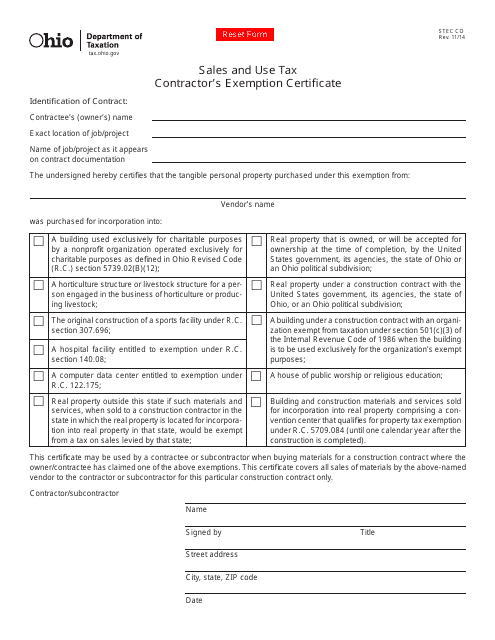

A computer data center entitled to exemption under RC. Then the contractor should provide Sales and Use Tax Contractors Exemption certificates Form STEC CO to its suppliers. Ohio Sales Tax Exemption.

Printing and scanning is no longer the best way to manage documents. A Into real property under a construction contract with the United States government or its agencies the state of Ohio or an Ohio political subdivision. Step 1 - Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions.

D An exemption certificate is fully completed if it contains the following data elements. 2 If a construction contractor is claiming exemption from sales or use tax on the purchase of materials for incorporation into real property the construction contractor must comply with rule 5703-9-14 of the Administrative Code. 2 Get a resale certificate fast.

Ad Download Or Email STEC CO More Fillable Forms Register and Subscribe Now. B Into real property that is owned or will be accepted for ownership at the time of. Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the project where the property will be.

Ohio law provides that contractors are consumers of the tangible personal property that they install into real property. You can download a PDF of the Ohio Contractors Exemption Certicate Form STEC-CO on this page. The contractor may purchase the tangible personal property exempt from sales tax in this situation as a sale for resale.

The buyer can benefit from the exemption by using this certificate when. Ad New State Sales Tax Registration. Nevertheless a construction contractor may purchase exempt from tax those materials or services that will be incorporated.

Real property outside this state if such materials and services when sold to a construction contractor in the state in which the real property is located for incorpora-tion into real property in that state would be exempt from a tax on sales levied by that state. These forms may be downloaded on this page. They do however pay sales tax on the supplies they purchase.

Are not subject to sales and use tax. The businesses we spotlight this month are just a few of the great entrepreneurs and businesses that are helping Ohio get ready for summer. As the consumer the contractor is re sponsible for paying sales or use tax on the purchase of the tangible personal property to be installed.

Consumer to pay tax - report of tax - exemption certificates. E A construction contractor who also makes substantial sales of the same types. Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Ohio Tax Exempt Form online e-sign them and quickly share them without jumping tabs.

Ohio Sales Tax Exemption Form On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real property improvement. A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale by division E of section 573901 of the Revised Code. Contractors purchasing goods to install in a tax-exempt project should use this form.

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Ohio Tax Exempt Form Holland Computers Inc

Uniform Sales Amp Use Tax Certificate Liquidation Com

Form Stec Cc Download Fillable Pdf Or Fill Online Sales And Use Tax Construction Contract Exemption Certificate Ohio Templateroller

Word Google Docs Apple Pages Free Premium Templates Contract Template Agreement Free Brochure Template

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

61 Pa Code 31 13 Claims For Exemptions

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Sales And Use Tax Construction Contract Exemption Certifi Cate

Form Stec Co Download Fillable Pdf Or Fill Online Contractor S Exemption Certificate Ohio Templateroller

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online

Form Stec Co Download Fillable Pdf Or Fill Online Contractor S Exemption Certificate Ohio Templateroller

How To Get A Sales Tax Certificate Of Exemption In North Carolina

Form Sales And Use Tax Blanket Exemption Certificate Sales Tax Forms Tax Forms Legal Forms Passport Renewal Form